bradford tax institute cost

As you know from the article titled How You the Small-Business Owner Can Cash In with Tax Credits for Health Insurance on Employees your small-business health insurance might qualify for big tax credits. After 90 days refunds are offered on a pro-rated basis.

Tax Course Bradford And Company

1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail.

. Three ways our fact-filled article can help you. Thats why I created my manual Business Tax Deductions for one-owner and spouse-owned businesses proprietorships S corporation C corporations limited liability companies 1099 and statutory employees. Bradford Tax Institute Blog.

How Much Does the New Health Care Law Cost You. Quality of products or services. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail.

Traffic rank provides an estimate of the websites popularity by comparing level of visitors that visited the site every month to other sites around the world. 351 San Rafael CA 94903 Telephone. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount youll pay the standard premium amount and an Income Related Monthly Adjustment Amount IRMAA.

Subscription Services 1050 Northgate Dr Ste. The Tax Reduction Letter is published by the Bradford Tax Institute which was founded by W. This means you can deduct those sports teams costs as business expenses for federal income tax purposes.

Bradford is the publisher of Tax Reduction Letter a monthly tax-smart publication for the self-employed and author of numerous books and courses including his most current title Murray Bradfords Business Tax Deductions 2015 a comprehensive on-the-go tax course published by Bradford and Company Inc. The tax ideas strategies and tips at this site come from the Tax Reduction Letter a publication written for the one-owner business in plain English but annotated for the tax professionalBoth tax professionals and business owners find big benefits from this resource. The standard Part B premium amount in 2022 is 17010.

Who is going to pay for your small-business tax credits. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail. Since 1989 Bradford and Company has found billions of dollars in new deductions and.

I emailed about 3 times with a ton of questions and i cant say just how thorough they were with. The Bradford Tax Institute dedicates itself to helping you pay less in taxes and be less afraid of an IRS audit. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

How an IRS mistake can cost you big money. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail. It should come as no shock that the IRS isnt perfect.

We produce top notch qualified practitioners for a variety of medical field careers. Bradford Tax Institute Blog. Branford Institute provides flexible healthcare training services for those aspiring to enter the healthcare field.

Most people pay the standard Part B premium amount. My name is Murray Bradford CPA. No unresolved complaints againt Bradford Tax Institute.

The tax reduction letter is published by the bradford tax institute which was founded by w. Heres a resource guide that gives you the Tax Cuts and Jobs Act tax reform articles published at the Bradford Tax Institute from January 1 through July 31 2018 including for each article the a topic b code section c prior law d new law and e link. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail.

The ruling states that the monies spent to outfit and support your team are similar to monies spent on other methods of advertising. Bradford Tax Institute Blog. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

Well explain the importance of Revenue Ruling 70-393. Bradford is the nations pre-eminent tax reduction expert having found an average of 17700 in new tax deductions for over 500000 and counting small businesses and self-employed professionals. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail.

Is the market leader and expert in tax reduction seminars and products for the self-employed business owners. Rate your experience with Bradford Tax Institute. How Cost Segregation Can Turn Your Rental into a Cash Cow.

Bradford and Company Inc. Learn how the Bradford Tax Institute can help you as a tax professional help your one-owner clients pocket more after-tax money and become raving fans. Murray Bradford in 1991.

What Bradford Tax Institute customers think NEW. Best of all hosting of a Bradford Tax Seminar wont cost youor your peoplea penny. Bradford Tax Institute Blog.

Responsiveness to problems or complaints. How is my subscription guaranteed. Branford Institute offers two certified medical training schools located in New Jersey.

Bradford Tax Institute Subscription Services 1050 Northgate Dr Ste. 351 San Rafael CA 94903 Telephone. In 1979 I began developing tax strategies for the self-employed and one-owner businesses.

Self Employment Tax What Is The Self Employment Tax In 2019

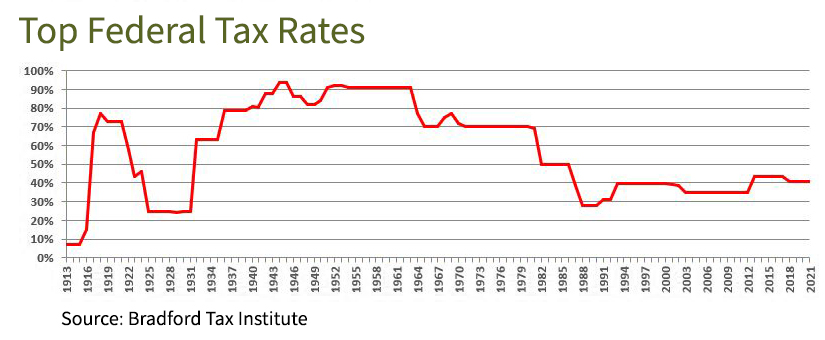

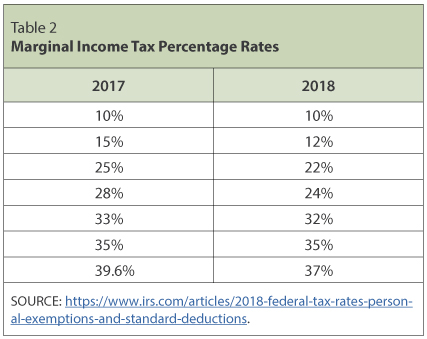

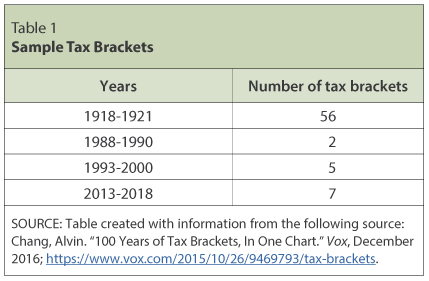

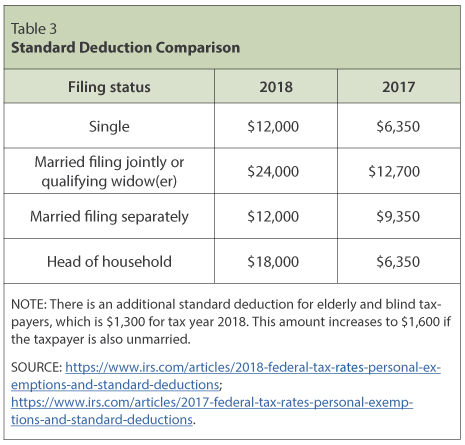

Individual Income Tax The Basics And New Changes

Individual Income Tax The Basics And New Changes

Amazon Com How To Beat The Irs With Tax Saving Business Strategies 9781790810123 Zubler David C Books

Tax Reduction Letter Tax Smart Solutions For The Self Employed

Individual Income Tax The Basics And New Changes

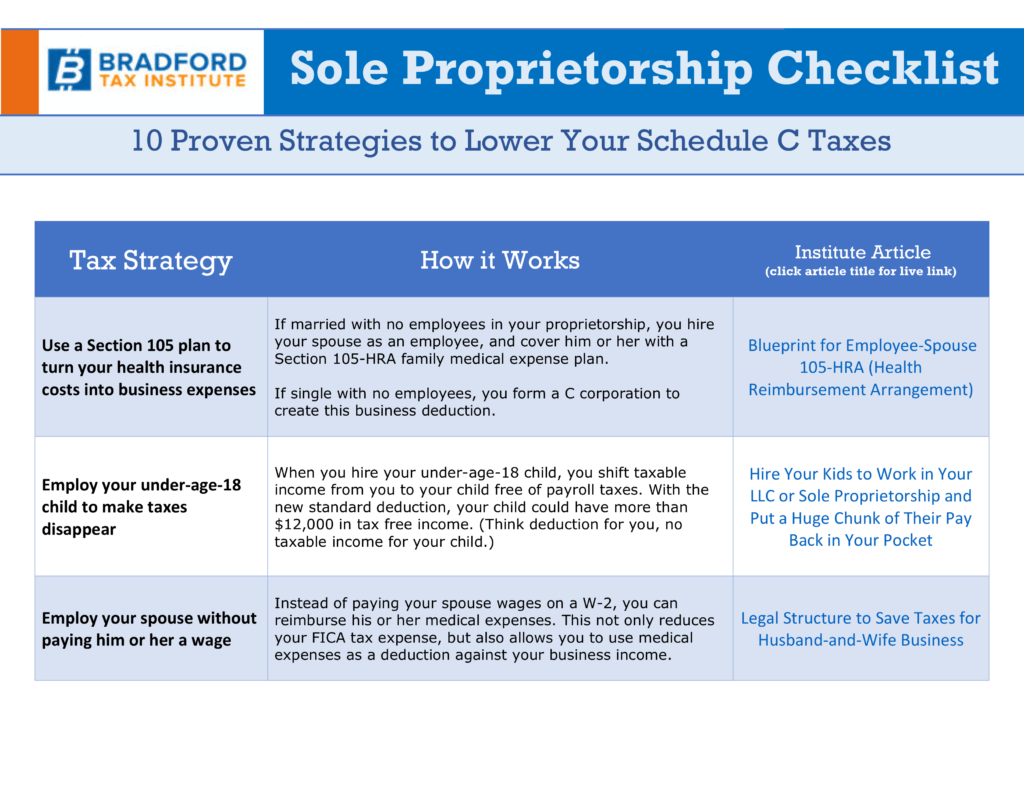

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors

Robin Smith Cheif Operating Officer Bradford And Company Inc Linkedin

Individual Income Tax The Basics And New Changes

The 651 958 00 Email Series Membership And Subscription Growth